1 month by cncdivi

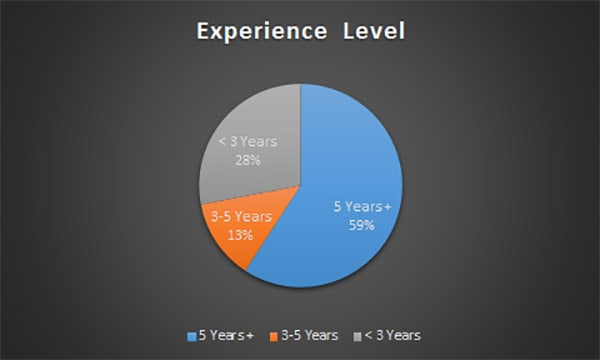

The outcome of this year’s CAD Software survey is available. As I pen this down, we’ve accumulated over 300 answers and the count increase at a brisk pace. I anticipate we might receive many more. However, I decided to proceed with the evaluation and present the preliminary statistics.

Just like our 2013 CAD Survey results, we’ve divided things into various segments:

– Mainstream/Overall: This is every package that got a 1% or better share. There will still quite a few below 1% that got 1 or 2 votes, but they’re not statistically valid against the bigger numbers.

– Pro: These are the more expensive packages like Solidworks.

– Mid: These packages are charged for but are typically not as expensive as the Pro packages.

– Free: There’s always a market for Free, and these tools get better every year.

– CAM: Another way to save money is to use the CAD that comes with many CAM packages.

Let’s drill down into each category and see how things look. We’ll also do a little retrospective on what’s changed since we surveyed in 2013.

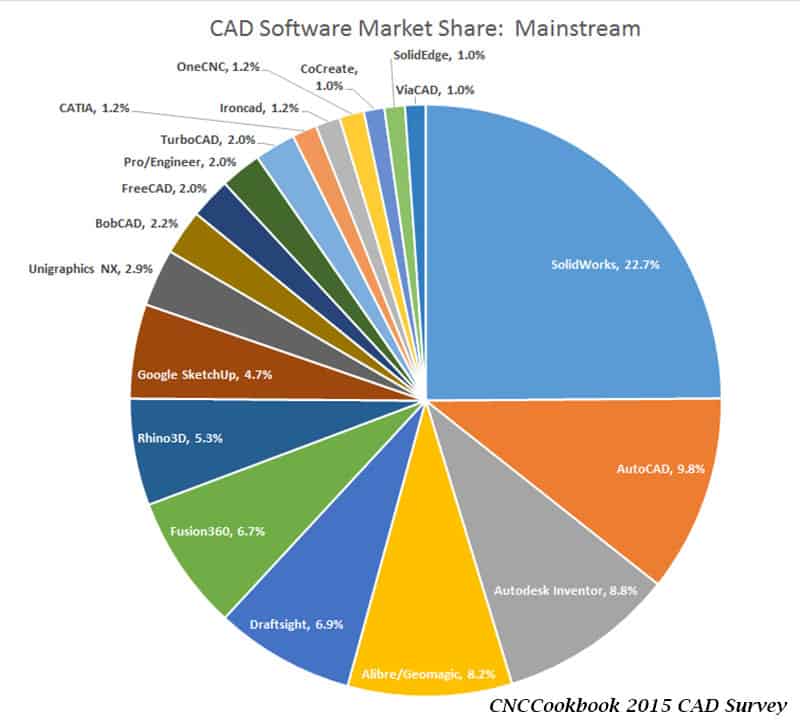

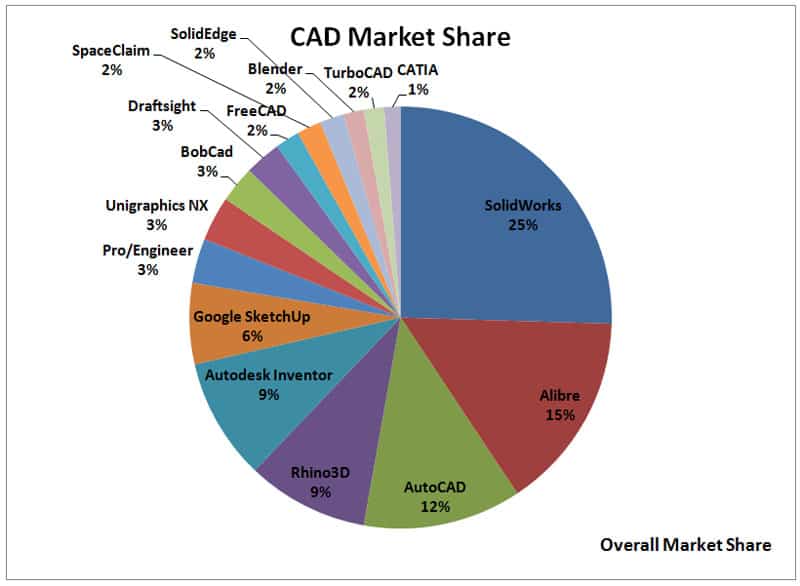

Mainstream/Overall

This is our best estimate of overall market share without trying to segment the market…

This chart gives our best estimate of overall market share without trying to segment the market. Comparing it to 2013 we can see:

– Solidworks is holding on to its #1 spot, though it did drop from 25% to about 23%. You really can’t fault this product and it is a CAD staple for CNCCookbook too like so many other companies.

– AutoCAD has unseated Alibre, although its overall share fell from 12% to 9.8%.

– Inventor also moved up relative to Alibre (now called Geomagic), and stayed in the 9% range.

– Alibre fell quite a ways from the #2 spot at 15% all the way to 8.2%. That’s an interesting move. We’ll have to see what it does on the next survey, but it doesn’t look too good.

– Draftsight is up quite a lot, from 3% in 2013 all the way to 6.9% today. Obviously they’re taking some share from somewhere.

– Fusion360 is also a big new player, weighing in at 6.7%. We’re Fusion360 users here at CNCCookbook, though we hoping to see a lot of usability improvements from them soon. All in all, it looks like Autodesk is really firing on all cylinders in this market. Taken together, the 3 products add up to 25.3%. I think we may have found the missing Alibre market share.

– Rhino3D also lost some ground, moving from 9% down to 5.3%. I hate to see that as Rhino is one of my favorite CAD programs.

– Google Sketchup lost a little overall share. I believe the cheap and free CAD software is better suited to CAD than Sketchup and that’s what’s doing it.

There’s more change as we get to the less popular packages, but I think such changes are better analyzed once we segment the markets.

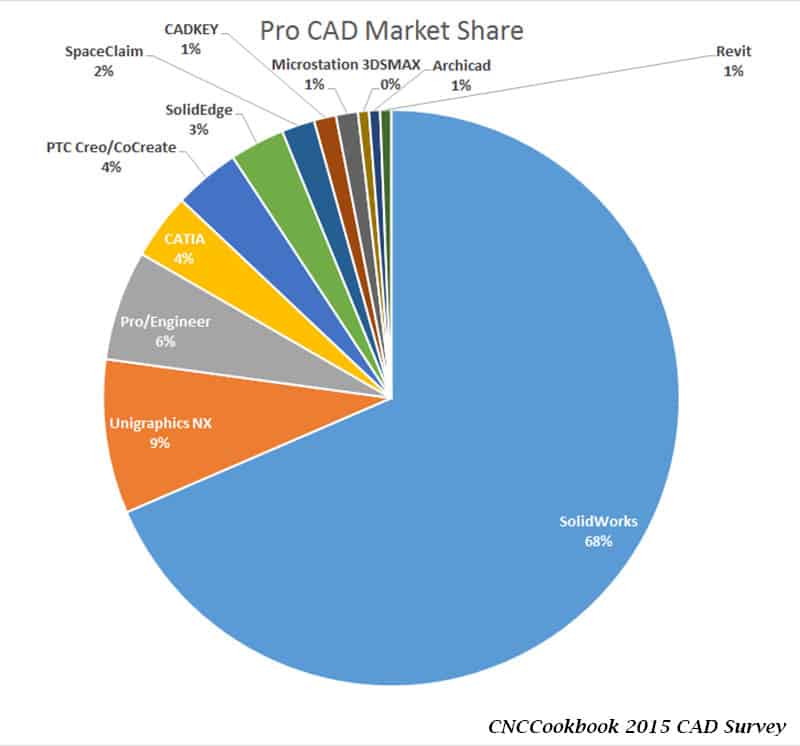

Pro

These are the most expensive packages and (theoretically) therefore the most capable:

Solidworks dominates the Pro category…

As everyone probably expects, Solidworks dominates the Pro category and in fact their share of this category has moved up from 62% to 68%. It’s good to see healthy growth.

For the other packages we see:

– Unigraphics NX has passed Pro/E for the #2 spot. It looks like almost a direct trade off in share.

– CATIA has moved up from 3% to 4% and taken the #4 spot.

– CoCreate is moving up to from 1% to 4%. Great move for them.

– SolidEdge and SpaceClaim look like they’ve slid a bit.

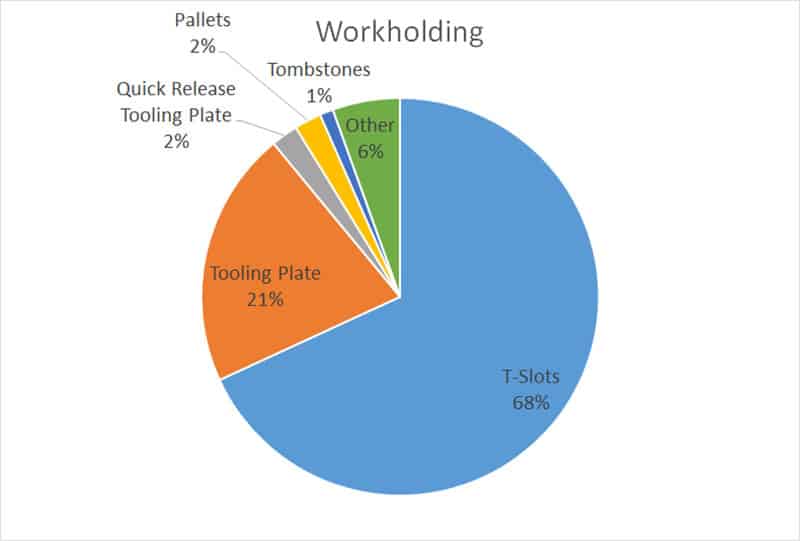

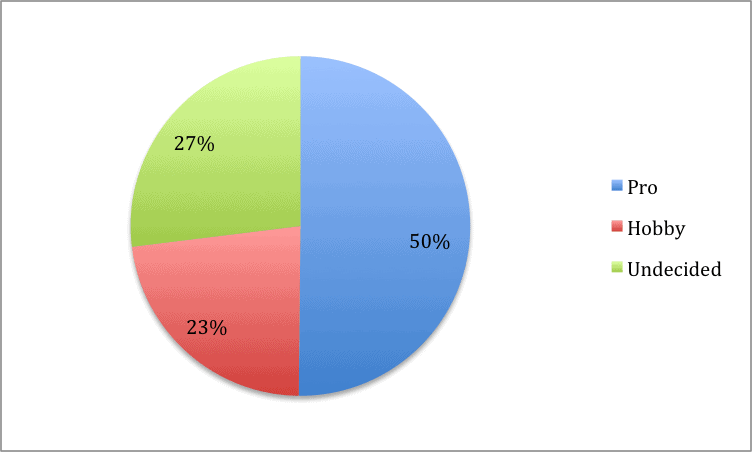

We’re also seeing more architectural CAD packages in the survey, which I suspect means we have more from the CNC Router / Woodworking community among the readership. Pro represents 33% of the survey responses.

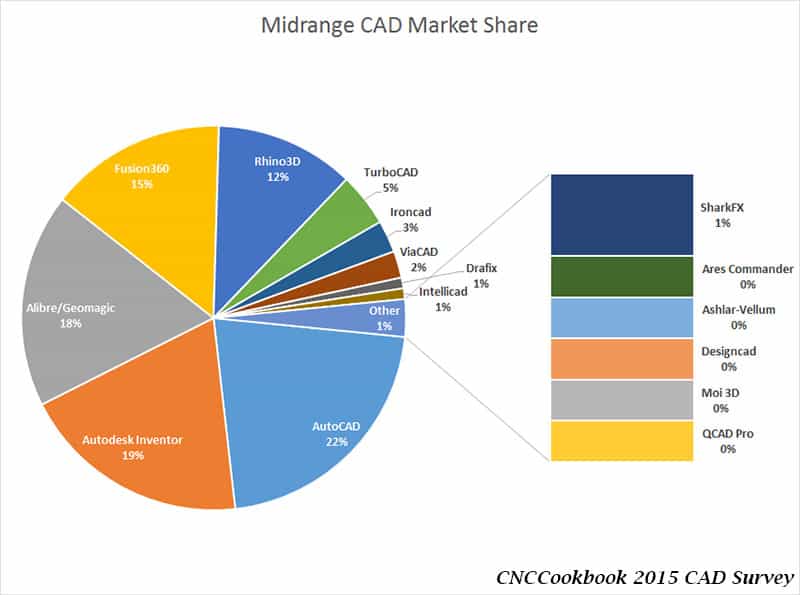

Mid

The Mid market straddles cost-conscious Pros and Hobbyists alike, so it is always interesting:

Lots of players in the Mid-Market for CAD…

There are lots of players in the Mid-Market for CAD. Comparing to 2013, the first thing we see is a big drop off for Alibre, which had been the #1 Mid-Market choice. It’s gone from 30% share down to 18%, a big change. Autodesk is really dominating this market as the own #1, #2, and #4 slots. Had they been the ones to buy Alibre there wouldn’t be much Mid-Market left except for Autodesk. Of course Fusion360 wasn’t in the 2013 survey, so it has really gained share quickly.

– Looks like Rhino3D has felt a lot of that market share loss as they went from 19% share down to 12%.

– TurboCAD, meanwhile, grew from 3% to 5%.

– IronCAD is another that didn’t appear on the 2013 results and it has taken up a 3% share here.

Mid represents 45% of the survey responses.

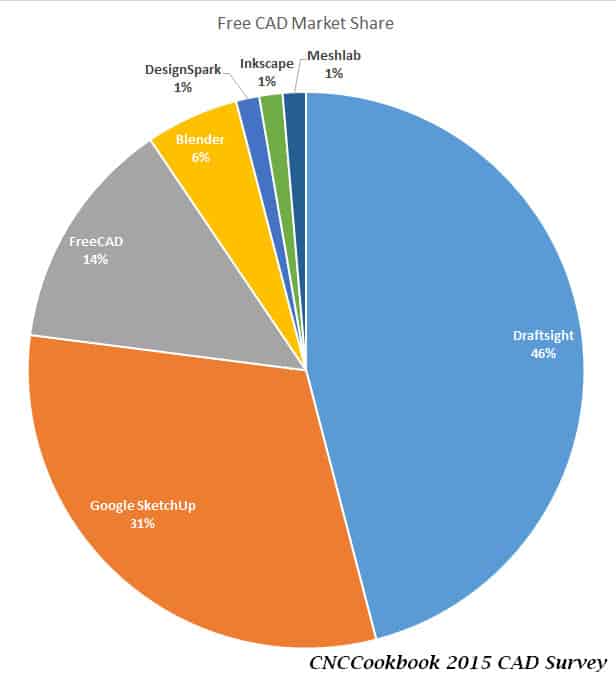

Free

Nothing wrong with Free if it does what you need it to do. This is largely a hobbyist segment, but still very interesting nonetheless:

Draftsight has totally unseated Google Sketchup in the Free category…

The big news here is that Draftsight has totally unseated Google Sketchup in the Free category. Obviously I need to take a look at it.

– FreeCAD is pretty flat at 14%

– Blender is down to half what it was from 12% to 6%. Blender is mostly useful to the 3D printing crowd it seems to me, but I wonder what took the share from it.

– Meshlab and DesignSpark are new for this survey while VisualWorks has disappeared.

Free represents 15% of survey responses.

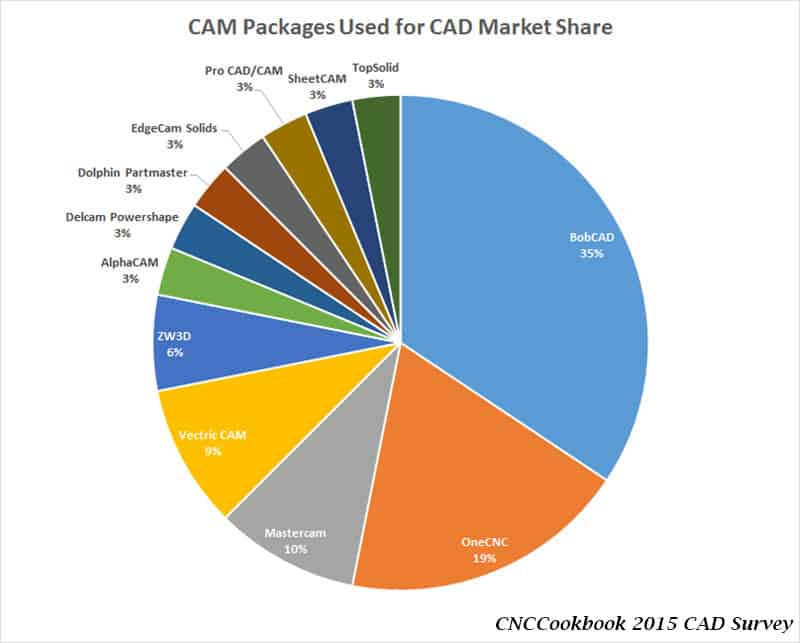

CAM

As I said on the 2013 survey results:

Who says you have to buy a separate CAD package at all? Many CAM packages include integrated CAD functionality. In some cases, it’s powerful enough that a separate CAD program may not even be necessary. This category covers that case. BobCad users clearly find it adequate to use the program’s built in CAD as there are quite a few of them doing it that way. EdgeCam, MasterCAM, OneCNC, and GibbsCam are all relatively expensive CAM programs that have significant CAM functionality available right in the same software.

While CAM-based CAD is often less powerful than software built especially for CAD, it does have one important advantage which is that the two are using exactly the same underlying geometric model.

Here’s the breakdown of CAM packages being used for CAD:

CAM packages being used for CAD…

BobCAD remains #1, although it has lost a fair amount of share, moving from 47% to 35%.

– OneCNC had a tremendous move upwards from 11% to 19%. It moved from #4 to #2 place. I’m a real fan of OneCNC. It was the first CAM package I used and I still use it very often to this day.

– Mastercam is still in the #3 position.

– EdgeCam lost quite a lot of share moving from 16% and the #2 position in 2013 to #9 and 3% in 2015.

– ZW3D is a new face here too, suddenly showing as #5 with 6% share.

CAM is only about 7% of survey responses–the vast majority of folks prefer to have a dedicated CAD package rather than to use their CAM for CAD work.

For more CNCCookbook surveys, check out our Survey Page.

Wondering How to Choose a CAD Package?

It’s not just a popularity contest–you want to choose the best package for your needs, which may be different than others. If you need to choose a CAD package, check out CNCCookbook’s 3 Step Process for Choosing CAD Software. You’ll be glad you did.

Like what you read on CNCCookbook?

Join 100,000+ CNC'ers! Get our latest blog posts delivered straight to your email inbox once a week for free. Plus, we’ll give you access to some great CNC reference materials including:

- Our Big List of over 200 CNC Tips and Techniques

- Our Free GCode Programming Basics Course

- And more!

Just enter your name and email address below:

100% Privacy: We will never Spam you!

Recently updated on March 19th, 2024 at 09:23 am

Bob is responsible for the development and implementation of the popular G-Wizard CNC Software. Bob is also the founder of CNCCookbook, the largest CNC-related blog on the Internet.

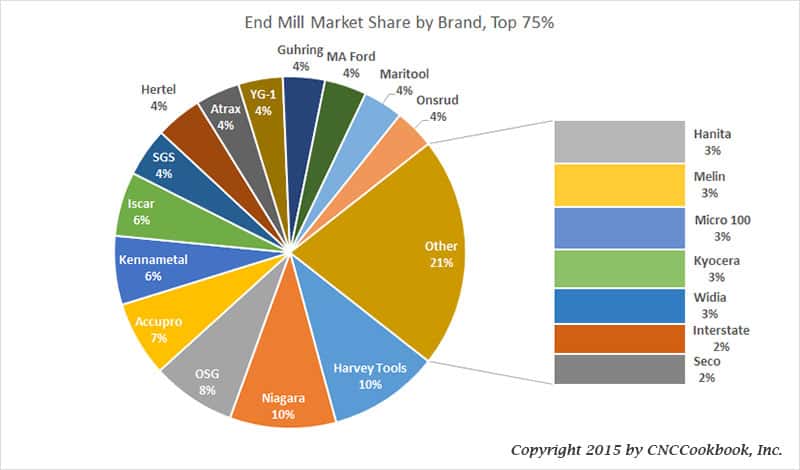

Eric, we haven’t done one on endmill brands, but I agree, it’d be a fun one to try.

Curious about SPRUT I don’t see it on the list. Am I missing something or is the usage that low based on respondents?

Matt, remember, this is just about CAD. To the extent that CAM software is being mentioned, it is only that those folks are using the built-in CAD on their CAM instead of a stand-alone CAD package. Usage for Sprut in that regard was too low to show up. Usage of Sprut as a CAM pakage shows up nicely if you go back and look at our CAM survey last year.

Draft sight and cambam are very low cost. Cambam has incredible user support. I get expert advice within hrs, thanks to a few individuals. There is little that cambam won’t handle. Draft sight is basically autocad which handles all the geometry I’ve needed.

I didnt see CAMWorks up there, which is surprising to me based on how many people use SolidWorks.

I’ve started using OpenSCAD and that seems quite powerful enough for most of my requirements. So far I’ve only used it for models to be printed but I think I’ll give it a try out as a visualisation for a welded window frame I plan to make.

Isn’t Pro CAD/CAM the product that preceded CAMWorks?

I agree CAMWorks would not qualify since it’s not standalone.

That’s why these surveys can be a bit short on the big picture.

Even though CAMWorks is not one of the huge players, it would be nice to see where they fit in the market share.

I have been using HSM 2.5D integrated into SolidWorks for about six months. I am having a very good experience with the product. 2.5D is free, I think the 3D version is beyond $5k. For our operation, 2.5 works very well. I didn’t see HSM in the pie chart for CAM. I would be nice to have GWizard integrated into HSM/SolidWorks. Everytime I start a new operation I go out to GWizard to get my feeds and speeds right.

I’m very interested in learning cad/cam and building a cnc machine. To be honest with you I don’t have a clue where to start. This will be used for an addition to my woodworking hobby. Do you know of free stuff until I get a good understanding or maybe guidelines to follow. Thanks so much for your help.

Bo, some of the Cloud offerings let you start out free. Search our blog posts for Fusion360 and OnShape. There are other free offerings listed in the survey. I can’t comment on which is best for you, you need to try them out and see.

Lynn, see my response to Matt above. This is a CAD survey, not a CAM survey–you can find the CAM survey here:

https://www.cnccookbook.com/results-from-the-2014-cnccookbook-cam-software-market-share-survey/

HSMWorks did fine there. The only reason CAM winds up here is some people are using the CAD facility of their CAM as their CAD. It’s very much a minority, but they’re allowed to respond that way, so it is reported here.

Dear Bob,

Graebert is the developer of DraftSight (product from Dassault Systèmes) and ARES Commander. We found your graph very interesting but would like to suggest a different segmentation than in pricing.

In our segment we would for example compare AutoCAD, DraftSight, DesignCAD, TurboCAD, ARES Commander and IntelliCAD that are serving the same purposes at different levels.

The same could be done by comparing Solidworks with Inventor, Alibre, Fusion 360, Shark, Rhino 3D, Pro/E … etc.

Such a segmentation can for example be found on the website of G2Crowd (www.g2crowd.com/categories/cad).

I’m sure it would bring a different light to these results.

Congratulations and thank you for this work.

Cedric, I’m sorry but free is tough to compare to anything you’d pay for, particularly if the basis for comparison is simply popularity. I can’t see changing the segmentation on that basis, but I appreciate your input.

DraftSight is not only free. There is a Professional version and an Enterprise version. Some large accounts have more than 1000 seats of DraftSight Enterprise.

Besides lots of the comments you can see on this page show that users tend to use the free version for commercial use. The free version can easily be compared to AutoCAD LT for example.

Is PTC Creo included in your survey, or is that combined with Pro/Engineer? Perhaps it’s such a small share that it doesn’t register? Just curious why it doesn’t show up at all. Thanks!

Yes, it’s under Pro/Engineer as you guessed.

is this survey done globally or America only?

Our readership is global and so is the survey.

How responses do you have at this moment? Especially in the Pro section?

Adrian, many hundreds.

Strange to see freecad > openscad in these results. My experience has been that FreeCAD is relatively unknown compared to OpenSCAD (which has a good chunk of the O’Reilly maked users).

It’s curious to see that OnShape didn’t register here. I know that they’re new, but so is Fusion360. Is there just a weird venn diagram out there where OnShape users and the crowd contributing to this survey just don’t intersect?

David, just too new. But fear not. They figure prominently in our 2015 Cloud CAD Survey. I will publish the results of that survey tomorrow in the blog.