It’s time to present the results of the CNCCookbook 2021 CAD Survey!

I will present the results in two installments. The first is this article, and the second will be in the form of a further update to this article. If you’re part of our email newsletter (signup is below this blog post), you won’t miss one as I will announce each update in the email newsletter.

Without further ado, here is the first installment!

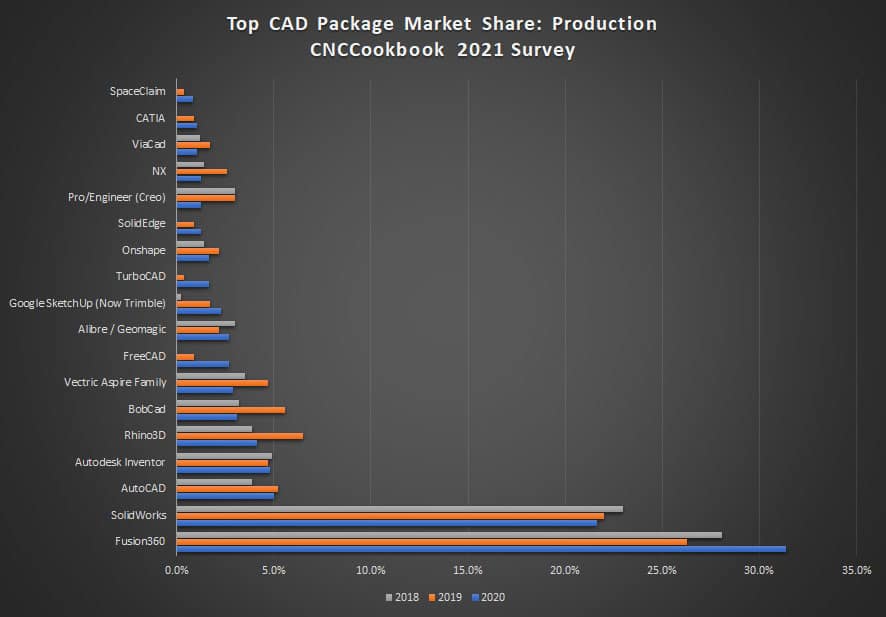

There were not quite 500 responses to our question about production CAD packages-up from about 300 last year. Thank you all very much for participating!

We have CAD Survey data for 2013, 2015, 2016, 2017, 2018, 2019, and now 2020, so we’ll be able to see a little market trending here too. BTW, I am calling it the “2021” survey because that’s when it was taken. But it is early 2021 and so I refer to the data in the charts as 2020.

Overall: Market Share of Packages Used in Production

In all, 46 packages were represented as being used in production by our respondents, up from 39 last year. Here’s what the overall share looks like without any attempt at segmentation. Let’s start with the Top packages, which comprise 91% of the market (up from 90% last year and 82% in 2018):

Last year, F360 was down on share a bit and this year it has bounced way up. Here at CNCCookbook, one effect of the Pandemic has been a lot more hobbyists joining that Professionals during this time. I suspect a lot of shops were either furloughed or keeping a lid on new purchases.

Solidworks lost a tiny bit as did many others. The two big losers were Rhino3D and BobCAD which had been #3 and #4 and fell to #5 and #6 respectively. Autodesk continues to consolidate its leadership position.

Vectric was a write-in this year like prior years, but it's share is way up. Again, I suspect this is due to a lot of hobbyist activity, and we will see some more data to support that shortly.

Most of the big heavy pro packages like SolidEdge, Pro/E, NX, and the like have slipped.

Alibre is a nice package that saw a modest gain in share. Onshape continues to shrink even after their acquisition.

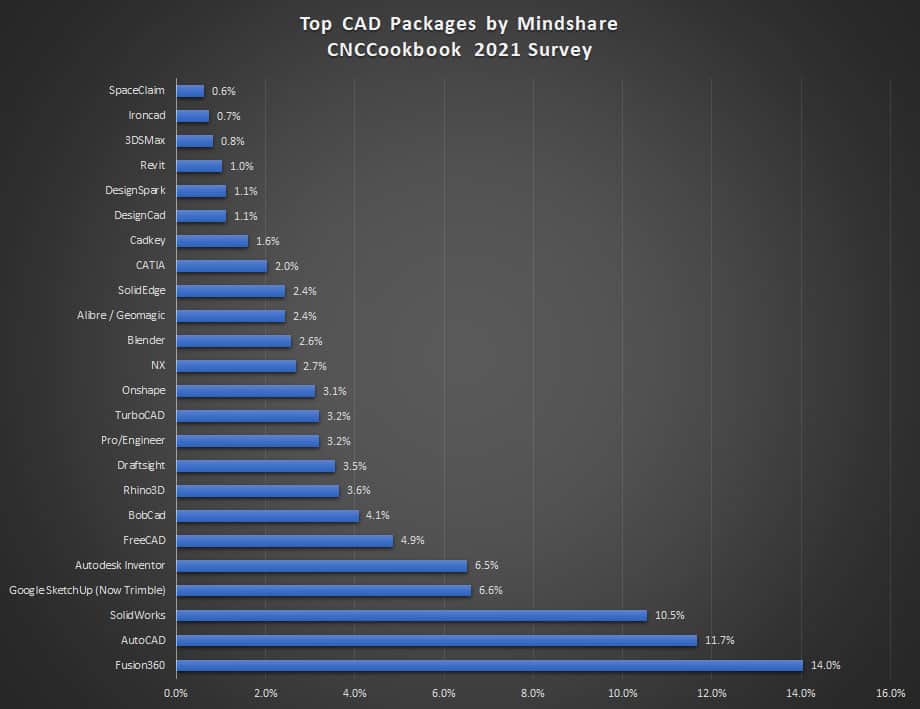

Overall: Mind Share of Packages Tried

If Market Share represents packages in production, packages tried is closer to being “Mind Share.” If you’ve tried a package, you’re aware of it so it has some mind share. We can also learn from the ratio of production market share to “tried it” market share. A package that has been tried by many and adopted by few is obviously different than a package where the majority who try it adopt it.

The average respondent tries about 3 or 4 packages before settling on one. If you're trying to decide on a package, be sure to try several.

The most commonly trialed CAD packages account for 94% of the trials, up from 82%. That surely reflects consolidation and loss of mindshare for smaller players:

F360 is down a fraction of a percent versus last year. Solidworks is down 1.7%. And AutoCAD actually gained nearly a percent.

SketchUp is up, Inventor is also slightly up, and FreeCAD wasn't even on the chart last year.

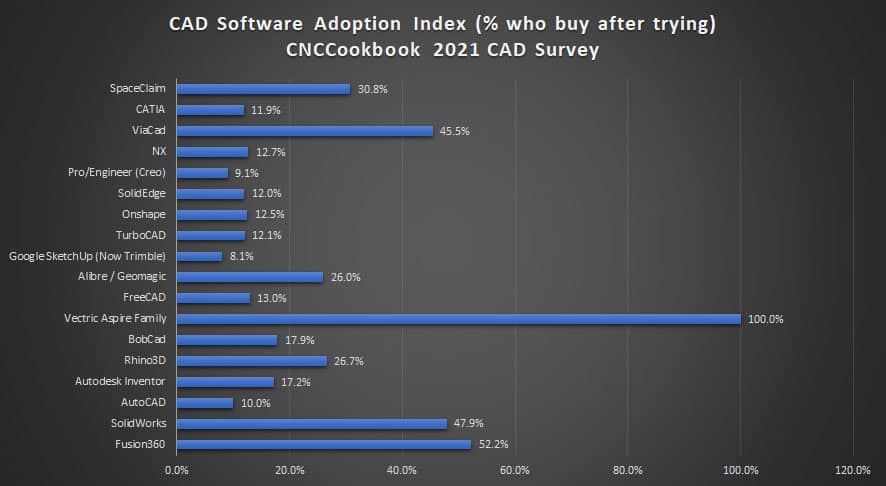

What about that adoption ratio? How many who tried wound up buying?

Here are the adoption results for the Top Production Market Share CAD Packages:

This is an interesting category because it shows how many who tried decided to buy. Therefore, these numbers are indicative of satisfaction achieved during a trial when evaluating the software. If the vendor is successfully getting their word out, then all other things being considered, the Adoption Rate should tell us who will grow by next year’s survey. Let’s see how that goes.

Solidworks had slightly edged out Fusion 360 last year but now it is the reverse. I’m not sure the numbers can be read that closely though–both have nice momentum on the journey from trial to purchase. I would say any of the players that converts more than 25% must have a pretty good "cockpit" experience for their trial users.

Adoption rates look good for all the top contenders on market share (and the list is sorted with higher market share at bottom of the graph). You can see that’s one reason they have such high market share–people try them and wind up buying.

Are You Evaluating New CAD At This Time?

Only a little over 11% of respondents are interesting in changing their CAD packages. It takes quite a while to learn one, and once you have mastered a package, it’s really tough to switch. This all provides friction that slows down market share changes. The number looking to change is a little higher than last year, but not enough to suggest major market shifts.

Hobby vs Pro Users

CNCCookbook serves a mixed audience of Professional and Hobby CNC’ers. Last year this survey had 64% of the participants were Professionals. This year that's fallen back to 55% Pro. As mentioned above, I've seen evidence all year that the Hobbyists were active as ever while the Pros seemed to slow down during the Pandemic.

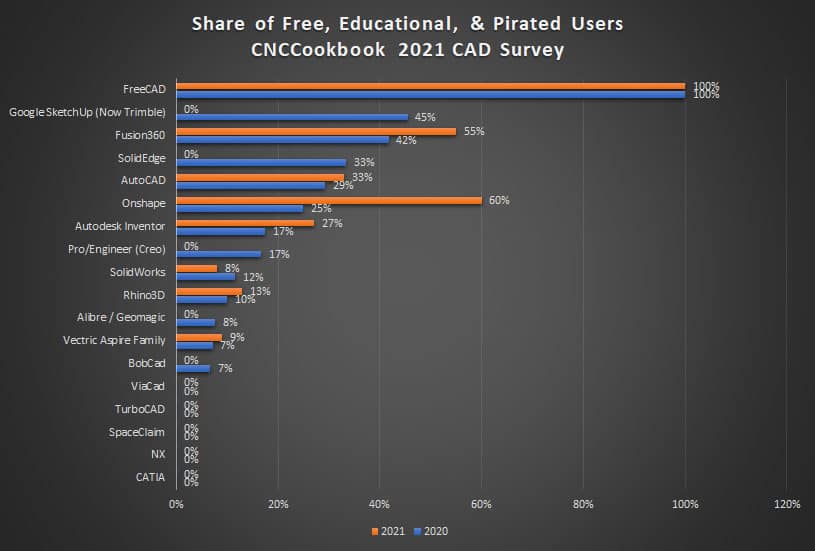

Analysis: Free vs Paid

Much like our CAM Survey, we can see that Fusion 360 is here to stay, but the major players aren’t going anywhere either. Like last year, a question was asked to determine the relative Free (plus educational and pirated) share vs paid share of the packages.

Here are the overall figures:

- Use a free, educational, or pirated version: 25%

- Paid full price: 75%

Despite Autodesk putting a lot of limits on free F360, free is up quite a bit from last years 21%. Times were definitely tough with the Pandemic.

It's worth keeping some perspective. In 2018, the free category was at 29% of respondents.

Free vs Paid Market Shares

Here is the breakdown on what percentage of the respondents are using Free/Educational/Pirated versions for each of the top packages:

There’s no denying that free is a powerful tool to drive adoption, so I find it all the more impressive when a tool that has very low percentages of free users does so well in the market share comparison.

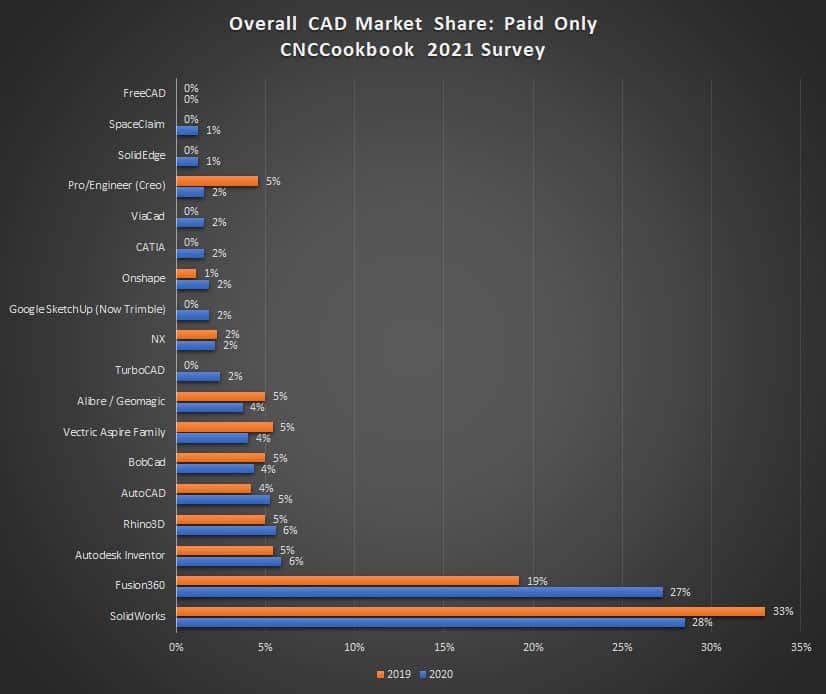

In fact, if we take out the free users, the market share situation changes pretty radically:

When we talk about packages that were paid for, SolidWorks jumps back to #1, although it lost considerable share from 33% last year to 28% this year. For a market leader, that is an extremely large drop.

F360, meanwhile, gained a huge number of paying users. Last year I had this to say about Free:

The interesting thing about free, is just as nature abhors a vacuum, shareholders abhor a lack of profits. Sooner or later most free things tend to get a lot less free. Free is typically used as a tool to accelerate growth until market dominance can be achieved.

We saw that prediction come true this year as Autodesk slapped a bunch of limitations on the free version of F360. Things like no tool changes and no G00 rapids. Apparently it made a huge difference if the increase in paid market share is any indication.

That's not the whole story though-see what happens when we slice the data to show Hobby vs Pro use:

Hobby vs Pro Market Share

Pros need different capabilities than Hobbyists, and they can afford to pay more for their tools. For example, Pros need to be able to exchange files in whatever format their customers operate, so it is much more important for them to use higher market share products. Pros also care how easy it is to hire folks who already have the skills to use whatever software they’ve chosen–also an argument to buy higher market share software.

Hobbyists, meanwhile, want simplicity and low cost first and foremost while raw power is number 2.

Here are the CAD Package Market Shares for Hobby Users:

"You failed to provide a text prompt. Please provide a text that needs to be rephrased."

Not surprisingly, F360 is by far the leader for the Hobby segment. After all, it offers Pro-level power at an amazingly cheap price. It's so good, I've often wondered how the next tier down survives.

I admit I am surprised to find SolidWorks in the #2 position. Fabulous product, but WAY too much money for most hobbyists. Next up would be Vectric, Alibre, AutoCAD, and maybe BobCad.

Rhino3D seems to be falling off. It's a pity, as I like the software, but my dealings with them suggest they can be difficult and a bit self-focused. I don't know if that's the reason for the fall-off, or whether the incredible price/performance of F360 is wearing them down.

Onshape continues to fall. No surprise. They pretty much snubbed the hobby world early on when they abruptly changed the nature of their free offering to make it almost unusable.

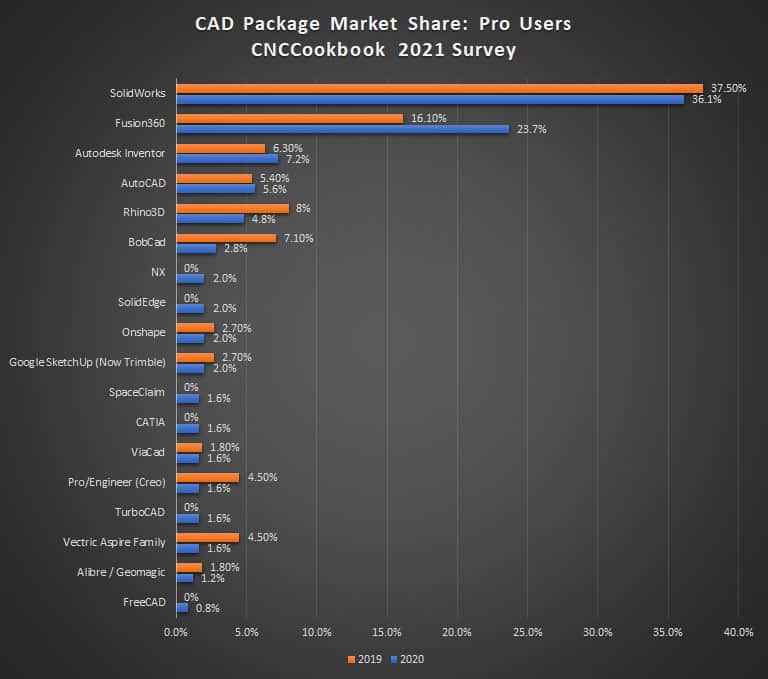

Here are the CAD Package Market Shares for Pro Users:

As I mentioned, Pro users have different needs from Hobbyists. They're also a lot slower to change away from something that's working and paid for.

Solidworks continues to enjoy commanding market share for Pro users, even though it has fallen off a bit since last year.

Despite the tendency for Pros to adopt slowly, F360 made subtantial gains, going from 16.1% to 23.7% of the Pro market. But, they clearly didn't take all that share from SolidWorks. If we look for big declines, we see some from Rhino3D, BobCAD, Pro/E, and perhaps Vectric.

Customer Satisfaction Awards

I’ve saved the best for last.

Respondents were asked to rank satisfaction with their production package as:

- It Rocks!

- It’s Okay

- Not Very Satisfied

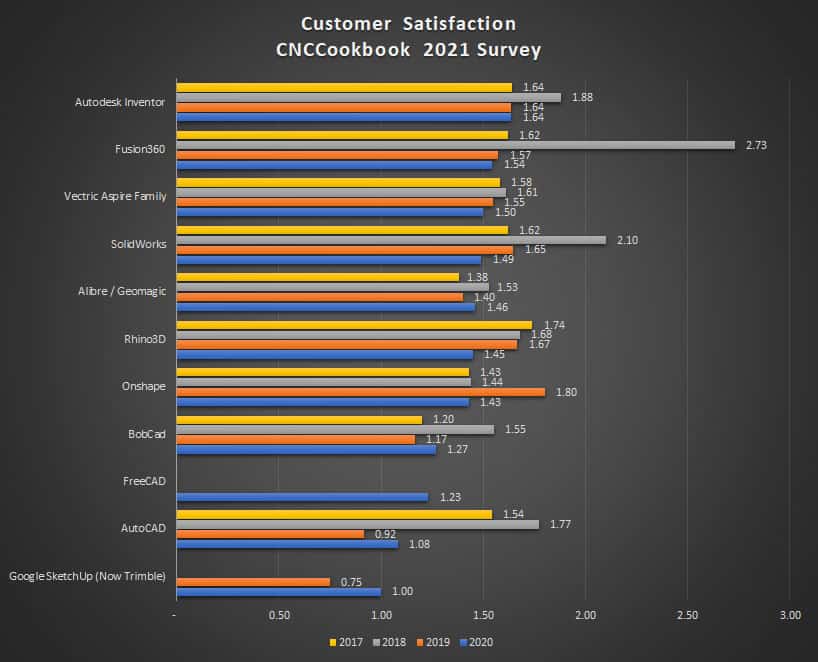

We awarded 2 points for It Rocks!, 1 point for It’s Okay, and -2 points for Not Very Satisfied and then combined it all to get our final Customer Satisfaction Scores. Based on those responses, we award a Gold and a Silver Customer Satisfaction Award to the first and second place packages.

Without further ado:

Gold Customer Satisfaction Award: Autodesk Inventor

Congratulations to the Autodesk Inventor team for taking the Gold Customer Satisfaction Award!

Silver Customer Satisfaction Award: Autodesk Fusion 360

Congratulations to the Fusion 360 team for taking the Silver Customer Satisfaction Award!

Custom Satisfaction Analysis

Here are the Customer Satisfaction detail scores for the last three years of our CAD Surveys:

The oldest scores are the yellow top bar while this year's scores are the bottom blue bar. As such, you can see the overall trend for these products.

For most of the products the trend has been downward. The Pandemic did not put CAD users in a generous mood.

Solidworks and Rhino3D suffered solid drops. Onshape had an even worse drop.

In terms of upward trends, Alibre, BobCAD, SketchUp and AutoCAD went up on their scores.

Be the first to know about updates at CNC Cookbook

Join our newsletter to get updates on what's next at CNC Cookbook.